Patriot Platinum Travel Medical Insurance Benefits: Health Insurance for Individuals, Families & Groups: Patriot Platinum is a travel medical insurance plan designed for people visiting the U.S. from another country. It provides medical coverage and other emergency services while you’re traveling outside your home country

The plan begins once you leave your home country and arrive at an eligible destination, and you can choose coverage for anywhere from 5 days to 365 days.

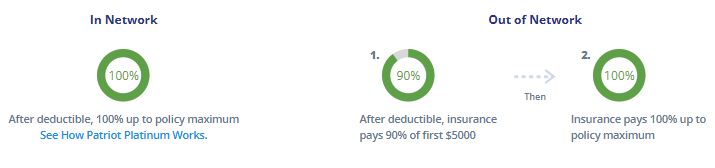

In the U.S., if you use a healthcare provider in the United Healthcare PPO network, the plan covers 100% of eligible medical costs after you pay the deductible. If you go outside the PPO network, the plan pays 90% of the first $5,000 of medical expenses, then covers 100% after that.

The plan also covers COVID-19, as long as you get sick after the policy begins.

For more details on coverage and exclusions, check the Patriot Platinum Insurance brochure.

Read Also:- African Safari for Travel Insurance: Top Plans & Cost

How Patriot Platinum Works

Key Patriot Platinum Travel Medical Insurance Benefits

Medical Coverage

| In-Network | 100% up to policy maximum |

| Out-Network | 90% of first $5,000, 100% thereafter |

| Available Policy Maximums | Limits may vary based on age or destination of traveler |

| Available Deductibles | Limits may vary based on age or destination of traveler |

Pre-existing Conditions

| Pre-Existing Conditions | Travel Medical plans typically do not cover pre-existing conditions unless they are classified as an acute onset of a pre-existing condition by a doctor and the insurer. Some common pre-existing conditions that are not covered include: – Patriot Platinum Travel Medical Insurance Benefits ✔ Pre-Existing Diabetes ✔ Pre-Existing High Blood Pressure ✔ Pre-Existing Heart Conditions Be sure to read your policy for any other exclusions or limitations. |

| Acute onset Pre-Existing Condition | up to $1,000,000 : Age 69 and below |

In-Patient

| In-Network | Average semi-private room and rate |

| Out-Network | Average semi-private room and rate |

| In-Network | 100% up to policy maximum |

| Out-Network | 90% of first $5,000, 100% thereafter |

| In-Network | 100% up to policy maximum |

| Out-Network | 90% of first $5,000, 100% thereafter |

Out-Patient

| Prescription Drugs / Medicines | 90% of first $5,000, 100% thereafter |

| In-Network | 100% up to policy maximum |

| Out-Network | 90% of first $5,000, 100% thereafter |

| In-Network | $25 copay, 100% up to Policy Maximum |

| Out-Network | $25 copay, 90% of the first $5,000, 100% thereafter |

| In-Network | 100% up to policy maximum |

| Out-Network | 90% of first $5,000, 100% thereafter |

| In-Network | 100% up to policy maximum |

| Out-Network | 90% of first $5,000, 100% thereafter |

Read Also:- International Business Travel Insurance Plans: Buy International Insurance, Policy & Business plan

Emergency Services

| In-Network | Up to 100% |

| Out-Network | 90% of first $5,000, 100% thereafter |

| In-Network | 100% up to policy maximum |

| Out-Network | 90% of first $5,000, 100% thereafter |

Travel Coverage

| Emergency Medical Evacuation / Repatriation | 100% up to policy maximum |

| Return of Mortal Remains | 100% up to policy maximum |

| Trip Interruption | Not covered |

| Trip Delay | Not covered |

| Lost Luggage | Up to $500, $50 per item |

| Terrorism | Up to $50,000 |

| Personal Liability | Up to $25,000 |

| Identity Theft | Up to $500 |

| Legal Fees | Not covered |

| Lost or Stolen Passport | Not covered |

| Missed Connection | Not covered |

Summary of Benefits

| Maximum Limits | Up to $8,000,000 |

| Deductible | $0 to $25,000 |

| Extensions | Up to 36 continuous months |

| Emergency Medical Evacuation | Up to maximum limit |

| Coinsurance for treatment received outside the U.S. (International) | 100% up to the maximum limit |

| Coinsurance for treatment received in the U.S. (America) | In the PPO network: 100% up to the maximum limit Out of the PPO network: 90% up to $5,000, then 100% |

| Incidental Emergency Coverage in the U.S. (Patriot International only) | 14 consecutive days maximum limit. Available only for a covered emergency medical evacuation or an emergency injury or illness that manifested during travel through the United States to or from the host country |

| COVID-19 / SARS-CoV-2 Coverage | COVID-19/SARS-CoV-2 shall be considered by the Company the same as any other Illness or Injury, subject to all other Terms and conditions of this insurance – Patriot Platinum Travel Medical Insurance Benefits |

| Acute Onset of Pre-Existing Conditions | Under 70 years of age, with varying limits by age up to $1,000,000. $25,000 maximum limit for medical evacuation |

| Travel Intelligence | Included |

| Telehealth | Included |

| Evacuation Plus | Included |

| Eligible Medical Expenses | Up to the maximum limit |

| Eligible Medical Expenses | Up to the maximum limit |

| Physician Visits/Services | Up to the maximum limit |

| Urgent Care Clinic | $25 copay. Copay is not applicable when the $0 deductible is selected. Not subject to deductible. |

| Walk-In Clinic | $15 copay. Copay is not applicable when the $0 deductible is selected. Not subject to deductible |

| Hospital Emergency Room (Inside the U.S.) | Injury not subject to emergency room deductible Illness: Subject to a $250 deductible for each emergency room visit for treatment that does not result in direct inpatient hospital admission. Up to the maximum limit – Patriot Platinum Travel Medical Insurance Benefits |

| Hospital Emergency Room (Outside the U.S.) | Up to the maximum limit |

| Hospitalization/Room & Board | Average semi-private room rate up to the maximum limit. Includes nursing service |

| Intensive Care | Up to the maximum limit |

| Bedside Visit (Hospitalized in an intensive care unit) | $1,500 maximum limit. Not subject to deductible. |

| Remote Transportation | $5,000 per period; $20,000 lifetime maximum |

| Supplemental Accident | $300 per covered accident |

| Outpatient Surgical / Hospital Facility | Up to the maximum limit |

| Laboratory | Up to the maximum limit |

| Radiology / X-ray | Up to the maximum limit |

| Chemotherapy / Radiation Therapy | Up to the maximum limit |

| Pre-Admission Testing | Up to the maximum limit |

| Surgery | Up to the maximum limit |

| Reconstructive Surgery Surgery is incidental to and follows surgery that was covered under the plan | Up to the maximum limit |

| Assistant Surgeon | 20% of the primary surgeon’s eligible fee |

| Anesthesia | Up to the maximum limit |

| Durable Medical Equipment | Up to the maximum limit |

| Chiropractic Care Medical order or treatment plan required | Up to the maximum limit |

| Physical Therapy (Medical order or treatment plan required) | Up to the maximum limit |

| Extended Care Facility Upon direct transfer from an acute care facility | Up to the maximum limit |

| Home Nursing Care (Upon direct transfer from an acute care facility) | Up to the maximum limit |

| Prescription Drugs and Medications (Dispensing limit per prescription: 90 days) | Up to the plan maximum limit, may not exceed $250,000 |

| Emergency Local Ambulance (Injury or illness resulting in an inpatient hospital admission) | Up to the maximum limit. Subject to deductible and coinsurance |

| Emergency Reunion (Must be approved in advance by the company) | $100,000 maximum limit. Not subject to deductible |

| Interfacility Ambulance Transfer Transfer from one licensed health care facility to another licensed health care facility resulting in an inpatient hospital admission | IMG pays 100% |

| Natural Disaster Evacuation Must be approved in advance by the company | $25,000 maximum limit. Not subject to deductible. |

| Political Evacuation & Repatriation (Must be approved in advance by the company) | $100,000 maximum limit. Not subject to deductible |

| Return of Minor Children (Must be approved in advance by the company) | $100,000 maximum limit. Not subject to deductible |

| Return of Mortal Remains or Cremation/Burial (Must be approved in advance by the company) | Up to the maximum limit for return of mortal remains or ashes to country of residence, or $5,000 maximum limit for cremation or local burial at the place of death. Not subject to deductible – Patriot Platinum Travel Medical Insurance Benefits |

| Accidental Death & Dismemberment (AD&D) Death must occur within 90 days of the accident | $50,000 principal sum. Not subject to deductible. |

FAQ’s

1. What is Patriot Platinum Travel Medical Insurance Benefits?

- Travel insurance is a type of coverage that protects against various risks during a trip. It includes benefits for medical expenses, lost luggage, flight cancellations, and other potential losses travelers may face while on their journey.

2. Am I eligible for the Patriot Platinum plan?

- The Patriot Platinum plan is designed for non-U.S. residents traveling to the USA or other countries outside their home country for a short stay.

3. Are pre-existing conditions covered by the Patriot Platinum plan?

- The Patriot Platinum plan does not cover pre-existing conditions but does offer coverage for an acute onset of a pre-existing condition, subject to age-based limits. For individuals up to 69 years old, coverage can go up to $1,000,000. However, for those aged 70 and above, coverage for acute onset of pre-existing conditions is not provided.

The attending doctor will assess if a medical situation is related to a pre-existing condition and if it qualifies as an acute onset. For detailed information, please refer to the Description of Coverage regarding acute onset criteria for pre-existing conditions.

4. What is the difference between Patriot Platinum and Patriot America Plus?

- Patriot Platinum offers more comprehensive and higher-level coverage than Patriot America Plus, making it a better choice for travelers looking for broader protection.

5. Which doctor or hospital can I go to?

- You can visit any doctor or hospital you prefer. Alternatively, you can choose to use the PPO network for the Patriot Platinum Plan, which is the United Healthcare PPO Network.

To find doctors or hospitals, you can use the Provider Directory.

Conclusion

Patriot Platinum Travel Medical Insurance Benefits: The Patriot Platinum Travel Medical Insurance provides reliable health coverage for individuals, families, and groups traveling outside their home country. It covers medical emergencies, hospital stays, and emergency evacuations, offering you peace of mind while you travel.

You can choose any doctor or hospital, or use the United Healthcare PPO network for added convenience. Whether you’re traveling for a short or long period, this plan ensures you’re protected against unexpected medical costs. Be sure to go over the policy details to make sure it fits your needs. For more information, visit webseriess.com.

READ MORE:-